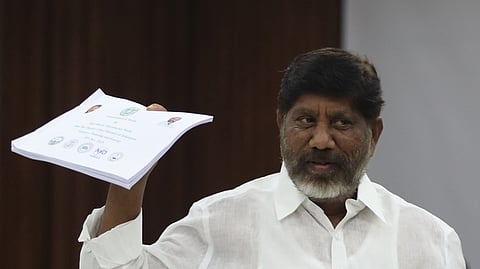

HYDERABAD: Ahead of the Union Budget, Deputy Chief Minister Mallu Bhatti Vikramarka urged the Centre to extend cooperation and financial support for various projects being implemented by the state government, while also seeking relaxation of FRBM limits to enable Telangana to raise additional resources for the education and health sectors.

Vikramarka raised these demands during the pre-Budget meeting chaired by Union Finance Minister Nirmala Sitharaman in Delhi on Saturday. According to officials, he highlighted the fiscal constraints faced by the state and pressed for greater flexibility in Centre–State financial arrangements to meet development needs.

Addressing the meeting, Vikramarka said, “In Telangana, we need to increase our capital investment rate from the present 37% to 50% of GSDP. It is necessary to enhance fiscal deficit targets to at least 4% of GSDP per annum. In addition, the 50-year interest-free loans given to states may be converted into grants and the amount of assistance may be doubled from the current levels.”

He pointed out that the Centre spends over 20% of its total expenditure on state and concurrent subjects and proposed that a 25% reduction in such expenditure would free up more than `2.21 lakh crore annually. This amount, Vikramarka said, could be transferred to states to address sector-specific and state-specific requirements.

The deputy chief minister further flagged concerns over the rising share of cesses and surcharges, stating that they now account for 20% of the Centre’s gross tax revenue. He noted that although the Fifteenth Finance Commission recommended a 41% tax devolution to states, they were effectively receiving only 30% of the Centre’s gross tax revenue.

“Surcharges are levied on income tax and corporation tax. The entire amount of surcharges amounting to `1,55,000 crore should be credited to a non-lapsable Infrastructure Fund, from which states can be given grants for infrastructure development. Alternatively, the entire amount of surcharges should be merged with basic rates to enhance the divisible pool of Central taxes,” he said.

Urging the Centre to accept all the recommendations of the 16th Finance Commission, Vikramarka said, “For the first time, the Centre had departed from tradition by not accepting the state- and sector-specific grants recommended by the 15th Finance Commission. As a result, Telangana lost `2,362 crore in state-specific grants and `3,024 crore in sector-specific grants.” He appealed to Sitharaman to accept all the recommendations of the 16th Finance Commission, stressing that fiscal transfers to states must be treated as a package.