Humans assume progress with lessons learnt from history helping avoid the repetition of the same mistakes. Economic historian John Kenneth Galbraith did not think this correct, drawing attention to the extreme brevity of memory. He thought there were few fields of human endeavour in which history counts for as little as in the world of finance. Today, familiar errors are being made.

Different But The Same

Commentators have repeatedly asserted that many of the key emerging market vulnerabilities have been addressed. Certainly, foreign currency reserves have increased. Banking systems have theoretically been strengthened. Fixed exchange rate regimes have been abandoned. More debt is now denominated in local currency. However, it is not clear whether the measures have increased resilience sufficiently to prevent new crises.

Emerging markets reserves increased after the 1997/98 Asia monetary crisis rising from around 10 percent to above 20 percent of GDP. Part of this increase reflected the post-2008 increase in global liquidity and the easy monetary policies pursued by developed countries. Subsequently, the pace of reserve accumulation has slowed and become more volatile. Despite improvement, based on the International Monetary Fund’s analytical assessing reserve adequacy (ARA) metric, many countries still have inadequate reserves.

Even where coverage appears adequate, caution is warranted. Reserves can be rapidly reduced by changes in trade balances, capital flows and changes in market conditions, such as monetary policy actions of major economies or rapid changes in commodity, especially food and energy prices. Long-term debt becomes short term with the passage of time or an acceleration event. Currency intervention can denude available funds. Reserve positions are also notoriously opaque; in 1997, the Bank of Thailand was found to have grossly overstated available currency reserves.

ALSO READ | The spectre of global slowdown and India story

Reserves may not be readily accessible. A substantial portion of China's US$3 trillion of reserves is committed to the Belt and Road infrastructure initiative and may not be fully recoverable. The ability to liquefy substantial holdings of US Treasury bonds and other foreign assets is limited by liquidity, price and currency effects. US actions to seize Russian central bank assets, restrict trading in securities and excluding the country from international payment systems highlight other uncertainties.

While new regulations have sought to fortify the financial system against losses, problems remain. emerging market banks, such as those in China and India, face well-documented asset quality concerns. The true level of Chinese and Indian non-performing loans ("NPLs") may be significantly higher than official reported levels. Banks in developing countries hold record levels of government debt.

Deterioration in public sector finances threatens financial stability. Support of the financial system and economic activity may pressure already weak public finances.

Despite reforms, enforceability of claims against emerging markets borrowers remains untested. The problem is aggravated by flawed investment structures. Emerging market borrowings are frequently undertaken through offshore special purpose vehicles which then on-lend the borrowed funds to where it is needed. This limits foreign investor access to the underlying real assets or cash flows and potentially subordinates their claims.

Equity investors in Chinese companies, such as Alibaba and Baidu, do not actually own shares but have a stake in a VIE (Variable Interest Entity), which simulates ownership in the Chinese company rather than granting direct title to the underlying assets. Such structures may not be legally recognised or enforceable, especially since they are designed to circumvent prohibitions on foreign investment.

Many of these issues, overlooked or accepted as simply an unavoidable part of emerging markets investing, may be exposed in any downturn with serious financial consequences.

Floating exchange rates and unrestricted foreign exchange movement are not necessarily always positive. In periods of uncertainty, they increase currency volatility and allow rapid capital flight.

Local currency debt has increased but unhedged foreign currency debt remains significant. Where the debt is denominated in the borrower's domestic currency, foreign ownership, attracted by higher returns, is substantial. While it shifts the loss from devaluation to the investor rather than the borrower, it aggravates capital outflows. Currency weakness and resultant losses cause foreign investors to exit exacerbating currency weakness, increasing borrowing costs and decreasing funding availability.

No Way Back

Irrespective of whether an emerging markets crisis eventuates, the prospects of emerging markets have deteriorated. The flaky optimism of the BRICS era has faded.

With a debt overhang, stagnating productivity, an aging population, limited policy options and political paralysis driving economic stagnation in developed countries, emerging markets cannot rely on exports to drive growth.

This is compounded by trade frictions which reflect fierce geopolitical and economic competition between the US and China. Tariffs, quotas and restrictions on technology transfers are likely to persist. In a low-growth world, nationalist agendas and a shift to more closed economies is likely.

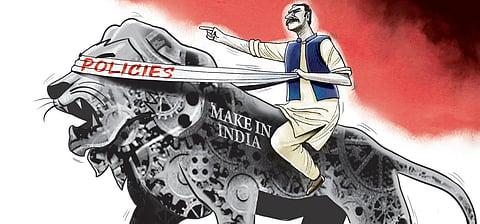

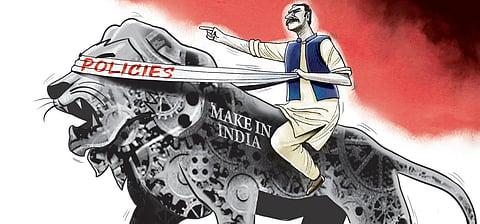

For emerging markets, these shifts are problematic. Weak demand and trade barriers limit the scope for lower-income countries to develop through export-oriented industries, such as textiles and manufacturing, reliant on cost advantages. In a parallel development, automation reduces demand for low-skilled cheap labour. It also reduces the cost differences between on- and off-shore production. Re-shoring industries becomes more attractive to minimise exposure to supply chain disruption, currency fluctuations and political interference. Only about 18 percent of global goods trade is now driven by labour-cost arbitrage. The limited progress on Prime Minister Narendra Modi's hallmark 'Make in India' initiative reflects these developments.

Higher-income emerging markets must overcome rising costs, labour shortages, infrastructure constraints, industrial shifts and growing restrictions on intellectual property transfer. Asia's emerging markets remain heavily reliant on manufacturing, a trend that started in Japan after the war. Emerging markets, with some exceptions such as India (IT), are weak in services.

Design and higher value-added components, especially for advanced products, are controlled by firms from advanced economies, who also own many major global brands. Developing nations access to technology through acquisitions, partnerships, licensing arrangements or hiring foreign experts is increasingly difficult. Current American policy seeks to prevent other countries, primarily China, from becoming a serious technological competitor. Further disruption comes from a drop-off in the exchange of talent and knowledge through interactions between students, professors, engineers and western companies. This limits the ability of emerging markets to increase productivity and move up the value-added chain.

As recent experience with sanctions against Russia and China illustrate, advanced economies, led by the US, now exert power through their domination of technological and financial networks which are essential to modern economies.

Wasted Years

The more limited outlook for emerging markets means that the promised improvements in employment and living standards will be harder to realise, at least for large parts of the population. For example, India needs to create around 10 million jobs each year to accommodate new entrants and urbanisation as well as reduce chronic underemployment. The struggle of many educated workers in emerging markets to get jobs consistent with their training and expectations will intensify.

The reality is that the recent period represents a tragic lost opportunity for emerging markets. Policymakers assumed that the favourable conditions would continue indefinitely. They did not realise that it was the result of a fortunate short-term alignment of events. The failure reflects short-termism, poor decisions, political expediency and, above all, hubris.

Larger countries with substantial domestic markets, such as China, India, and Indonesia, or rich in resources may muddle through but will fall well short of potential and fail to deliver on promises made to citizens. Most will face familiar recurrent existential challenges, trapped in an unending struggle to not go backwards.

The slow rate of improvement in ordinary lives, rising inequality and fragile and imperfect institutions will feed civil unrest and political and economic uncertainty. As Shakespeare's Richard II stated: "I wasted time, and now doth time waste me."

Satyajit Das is a former banker and author of numerous works on derivatives and several general titles: Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives (2006 and 2010), Extreme Money: The Masters of the Universe and the Cult of Risk (2011), A Banquet of Consequences RELOADED (2021) and Fortune’s Fool: Australia’s Choices (2022). His columns have appeared in the Financial Times, Bloomberg,WSJ Marketwatch, The Guardian, The Independent,Nikkei Asia and other publications. This is part of the web-only series of columns on newindianexpress.com.

© 2022 Satyajit Das All Rights Reserved