The ongoing Adani-Hindenberg face-off has put the spotlight on a least acknowledged fact. That our Indian banks have become whip-smart.

Had the Adani-like saga erupted say three or four years ago, either public or private lenders' would have found themselves burdened with indecent exposures and their credibility would have been skinned alive. Thankfully, Indian banks are no longer on the skid row and are doing business in a silkier way. RBI Governor Shaktikanta Das emphatically confirmed as much.

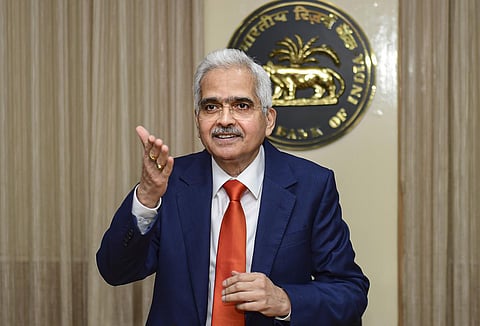

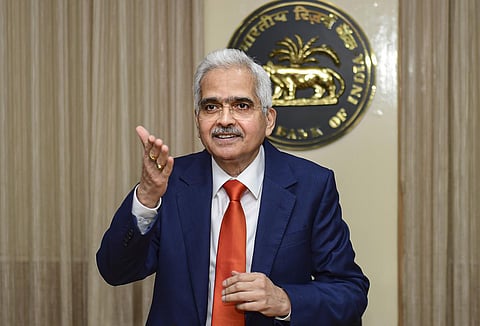

If the central bank issued a rare, all-is-well, clarification about banks' and financial institutions' exposure to the Adani Group last Friday, in yet another out-of-turn move, Das fielded questions on the unfolding hardships of Adani Group on Wednesday.

It's unusual to see a company-specific issue occupying so much space during the routine bi-monthly policy review press conference, but Das made an exception, least in the defence of Adani group, but to hammer home the point that the Indian banking sector remains resilient, well-capitalized and above all, their exposure to businesses is just what it should be -- in conformity with extant guidelines. With added emphasis, he declared that the banking sector's strength, size and resilience is larger and stronger to be affected by any individual incident like the Adani's.

Interestingly, international banks have relatively higher exposure to Adani Group than domestic lenders and the clarifications last week from RBI, banks and the Ministry of Finance should have settled it all. Still, the media tenderly shot off questions one after the other on Wednesday, prompting Das to conduct a crash course on the fundamentals of bank lending.

"I think this whole perception is coming because of the market capitalisation of the group (Adani Enterprises). When banks lend money to a company, they don't lend on the basis of market cap, but on the basis of the strength of the company, the fundamentals of the company and if it's a greenfield company, the anticipated cashflows and so many other things... And the appraisal methods of Indian banks has significantly improved over the years," he explained.

Supplementing him was deputy governor MK Jain who further clarified that banks and NBFCs exposure (to Adani) was insignificant, including pledged shares.

On another question whether banks that lent to Adani should be more prudent and consider increasing provisions, Das' reply was cut and dried: "First, when you say banks should be more prudent, that pre-supposes that banks are not prudent. Let me make it very clear that Indian banks are very prudent...and bank managements will take their own decisions, wherever they feel there's a need for additional provisions to be made. Why do you see only in the context of this case (Adani). There are so many cases, where there were early warning signals and there are so many cases, where banks assess the situation, I'm not talking about the case you are referring to (Adani), so many other cases, where banks make advance provisions. It's part of the regular risk management of the banks."

The entire Adani episode has drawn such unending concern, first to the company and then to markets and investors that despite several gestures including promoters paying up about $1 billion towards pledged shares, worry glands seem to be growing rapidly. Given the sour sentiment of international financiers, concerns were raised if Adani will increase its over-reliance on domestic banks and if RBI should step in issuing specific regulations. Das dismissed the need for any such regulatory nannying.

OPINION | Defending Adani, critiquing Hindenburg

Thanks to the expensive lessons learnt from the recent bad loans broom cleaning exercise, RBI's regulations introduced in the last 3-4 years should come in handy. These include guidelines to regulate the governance structures, functioning of the audit committee, risk management committee and others.

Besides, the banking regulator also made it mandatory to appoint both a chief risk officer, who reports directly to the audit committee, and a chief compliance officer. Among all, the chief regulation includes rationalization of the large exposure norms a couple of years ago. "The large exposure guidelines prescribed by the RBI are fully complied with by all the banks and the banking system is strong," Das concluded.