It's a do-nothing policy, with the RBI keeping the repo rate unchanged at 6.5% on Friday.

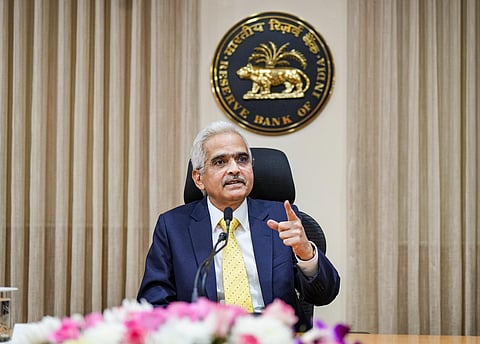

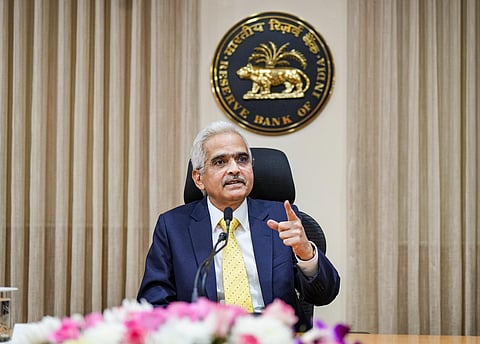

But as Governor Shaktikanta Das noted, the status quo is with regards to repo rate alone, as several moving parts are working behind the scenes to muscle inflation down to the target.

Global food and energy inflation prices could crank up yet again, but Das, with ample experience on his side, is standing ready: It's a turning pitch and we will play our shots carefully, he announced in his opening statement on Friday soon after sending out festive greetings.

With added emphasis, Das clarified that the central bank's mandate isn't the widely reported 2-6% band, and that his team of designated inflation-fighters won't rest until they cut it fine to 4% with decimal precision.

Headline inflation eased in August and is expected to further soften in September. Yet, the central bank has revised its Q2 inflation forecast to 6.4% from 6.2% projected in August. Further, price pressures may extend to Q3, which is why Das assured that the central bank remains in 'absolute readiness to prevent spillovers,' and anchor inflation expectations.

The 6-member Monetary Policy Committee (MPC) in a 5-1 split vote also decided to keep the policy stance unchanged at withdrawal of accommodation. The move allows RBI to prevent liquidity overhang from stoking inflationary fires, while supporting growth. The Standing Deposit Facility (SDF) stands pat at 6.25%, while Marginal Standing Facility (MSF) and bank rate remain unchanged at 6.7%.

Central bank rate hikes aren't to fight rearguard actions such as high inflation prints of previous months, but indicate the likelihood of future price rise.

By that logic, a rate pause in the past four successive policy reviews should reflect easing prices in coming months, and given the upcoming festive season, which spurs consumption and credit demand, further rate hikes seem unlikely as they can scuttle demand. Put another way, RBI may perhaps be walking that final bridge between pause and pivot (where rate cuts begin).

But one could argue that such a possibility amid what the global economy has been witnessing is extraordinary to say the least. For India, the second half of the fiscal, like the first half, continues to see threats from a loaded triple-barreled gun of higher global crude oil prices, price rise and other external uncertainties affecting rupee and exports.

These factors have been going round and round like a wheel, testing policymakers' patience and ability to overcome the full breadth of the flawed, imperfect and transitory nature of the monetary policy landscape like never before. But Das' 'turning pitch' doesn't include repo rate actions alone.

Over the last one and half years, though rate hikes grabbed all the attention, the central bank's timely compression of excess liquidity in the system helped arrest further inflationary flare up. Now, with rate hikes becoming a sideshow, a vigilant RBI hopes to deploy liquidity management tools to whip inflation into shape.

In fact, Das explained the recent episode of skewed liquidity distribution in the banking system. Typically, banks with surplus funds lend to others in need, but in the recent instance, some banks were parking excess deposits under RBI's SDF window earning interest, while others were borrowing via the MSF window, which firmed up the weighted average call rate (WACR), or the operating target of monetary policy.

Going a step further, the Governor gently nudged banks to warm up and explore lending in the inter-bank call market rather than passively parking funds under SDF at relatively less attractive rates.

Systemic liquidity has been in deficit mode for the past fortnight, and while markets expect RBI to address short-term liquidity needs through ad-hoc market operations, on balance, they see systemic liquidity to remain in deficit mode or at neutral, in sync with the central bank's anti-inflationary stance.

Meanwhile, though RBI retained FY24 projections at 5.4%, which itself is higher than the mandated 4% target, chances of it touching the upper tolerance band of 6% cannot be entirely ruled out. If it happens, that'll be a shot to the lungs of the MPC, which as it is missed its mandate in FY21. During the current fiscal, Q1 inflation was well within expectations at 4.6% and now, September print must be under 6%, else Q2 inflation too will breach RBI's revised estimate of 6.4%.

Though the overall inflation outlook is clouded by anticipated global food and fuel price shocks, the silver lining is declining core inflation, which eased by 140 bps from its January peak. Another piece of goods news came from RBI's surveys on anchoring of inflation expectations, which fell to single digits for the first time since Covid-19 pandemic.

As for Q3, inflation estimates are revised downwards to 5.6% from 5.7% earlier, but uneven monsoon and concerns over El Nino are already feeding into expectations of a fall in farm output, strengthening concerns over sticky food inflation. That could even delay recovery in rural demand, and add another needless wrinkle to growth, which is hoping for a 360-degree turnaround in both private consumption and investment.

The other factor that's likely to keep the inflationary impulse elevated is the global crude prices, which shot past $90 per barrel, higher than the RBI's assumed $85 barrel. However, this time around, higher crude prices will likely impact WPI inflation alone, as a pass-through to consumers seems less probable in a pre-election year. But a heftier import bill will be a drag on the fiscal and current account.