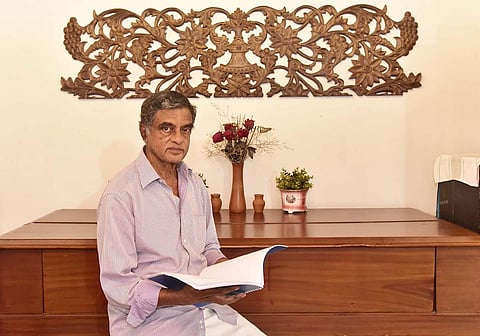

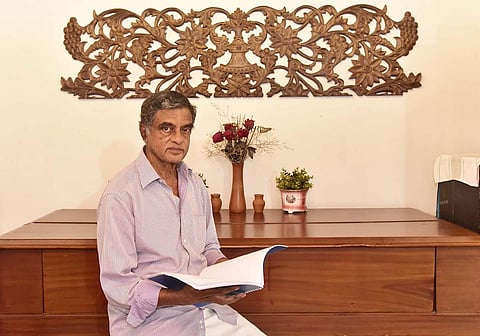

KOCHI: At the age of 74, Babu George Valavi is involved in the battle of his life. The stakes are high. Very high. If he wins, he and four family members get to take home a whopping Rs 1,448.5 crore, and he believes he has a strong case.

The story of Babu Valavi, a Kochiite, begins when he along with four other close relatives bought 3,500 shares constituting about 2.8% of Mewar Oil and General Mills Ltd -- then an unlisted Udaipur-based company -- in April 1978. Years have gone by, 43 to be precise. Over that period, the company got itself listed on stock exchanges, changed its name to PI Industries, and is doing pretty well with a market cap of over Rs 50000 crore currently.

As on Monday, the share price was quoted at Rs 3,410 apiece. And going by the original 2.8% stake, the Valavi family should now be owning around 42.48 lakh shares. At the current valuation, those shares are worth an eye-popping Rs 1,448.5 crore.

But there is a problem. Babu and the other four family members were kept uninformed about the company’s progress, and have been denied the company’s riches in the form of dividends, bonus shares, splits, etc., over these years, he alleges. Brazenly, the company now says Babu and his family members are no longer its shareholders as their shares were transferred to others in 1989.

Babu began associating with Mewar Oil and General Mills as its sole distributor (a clearing & forwarding agent) for almost a decade in the late 1970s and early 1980s. He says though begun as an edible oil company, it branched out to pesticides, and he was the C&F agent for the company’s pesticides product both in Kerala and Tamil Nadu.

Babu’s brother, the late George G Valavi -- a big businessman who was into shipping in Bombay during the 1970s and 1980s owning five ships -- and PI Industries’ founder-chairman P P Singhal knew each other on the Bombay business circuit and became family friends.

“When Singhal passed away in Bombay, it was my brother who used his contacts to arrange a charter flight to carry the body to Udaipur,” Babu recollects. Those days, when the company was looking for a distributor for their product in South India, Babu took up the business following his brother’s suggestion. “We bought the company’s shares too during that period,” he says. Since the shares were not traded initially and the local newspapers were not publishing the share prices, Babu kept the original share certificates safely in the cupboard.

“In 2015, my son started managing our activities and when he found the share certificates, we approached Karvy Consultants (the registrars of PI Industries) to demat (the process of moving physical share certificates to electronic bookkeeping) after finding that the shares are listed,” he says.

Karvy, in turn, asked Babu to contact the company.

“To our utter shock and disbelief, the company informed us that our shares were transferred to other people in September 1989,” says George K Valavi, son of Babu, who’s pursuing a CFA (chartered financial analyst) course, after completing his engineering degree. “The original shares are safe in our custody. The company secretary informed us that they have issued duplicate shares to us and that they have transferred the duplicate shares to other people in September 1989,” says George.

But, as per the Companies Act, to issue duplicate shares, the shareholder has to give FIR, newspaper advertisement, execution of indemnity bond and an affidavit in favour of the company. “We have not given the company any such documents and have not asked for duplicate shares to be issued,” says Babu.

PI Industries, in January 2016, sent its then director and now joint managing director, Rajnish Sarma, along with C H N Rao, former general manager, to Kochi to meet Babu and settle the issue after verifying the original share certificates. Babu says they had confirmed the genuineness of the original certificate and informed him that they will discuss the matter with the chairman. “After no action from the company, I contacted the chairman, but he was evasive in his reply,” says Babu.

In the meantime, the Valavi family approached the stock market regulator Securities and Exchange Board of India (Sebi). But, in reply to Sebi’s queries, PI Industries stuck to the position that the shares were transferred to other persons in 1989. Babu says there could also be a possibility that the “fraud” may have been done by some senior officials of the company without the knowledge of the top management.

Detailed queries mailed for comments by The New Indian Express to Raman Ramachandran, CEO and MD of PI Industries, vice-chairman Mayank Singhal, joint MD Rajnish and company secretary Naresh Kapoor did not elicit any response. Babu says Sebi has not closed the probe into the multi-crore "fraud" and he was still hopeful that an amicable settlement will be reached.