NEW DELHI: So, how can the RBI's decision to impose an incremental cash reserve ratio (ICRR) of 10% impact the liquidity in the banking system?

According to analysts, the decision will lead to temporary liquidity depletion of around Rs 1 lakh crore at an effective CRR of 14.5% for the period May 19 to July 28 (RBI has said this will be with effect from the fortnight starting August 12).

According to Madhavi Arora, lead economist, Emkay Global Financial Services, imposition of ICRR of 10% on Net Demand and Time Liabilities (NDTL) for the said period would imply a temporary liquidity depletion of around Rs 99,600 crore to Rs 1.15 lakh crore (excluding the HDFC twin merger). This she says assuming an effective CRR of 14.5% for the period concerned (existing CRR is 4.5%).

According to her, the immediate impact of RBI absorbing liquidity via ICRR will be mild hardening of money market rates for borrowers including NBFCs/corporates, while for banks as well there will be slight impact on their Net Interest Margin securities (3-4 bps) depending on the instruments where they were parking the money (assuming 14.5% effective CRR).

The announcement to impose 10% ICRR saw immediate reaction from the equity market with the Nifty Bank index falling from 44,980 to 44,479 in no time. However, the index has now consolidated around 44,700 levels.

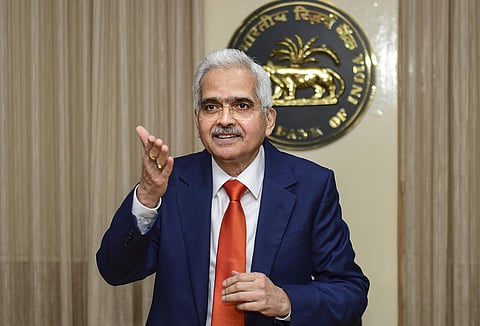

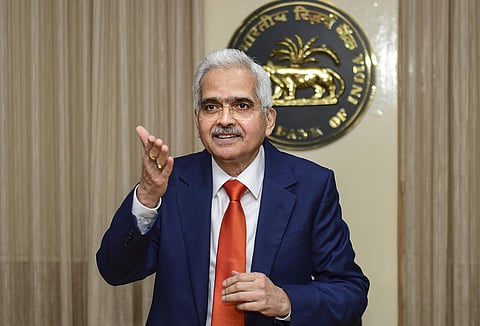

While announcing the imposition of 10% ICRR, RBI governor Shaktikanta Das said that this measure is intended to absorb the surplus liquidity generated by various factors referred to earlier including the return of Rs 2000 notes to the banking system.

ALSO READ | Conversational payment option on UPI soon

"This is purely a temporary measure for managing the liquidity overhang. Even after this temporary impounding, there will be adequate liquidity in the system to meet the credit needs of the economy," he said.

Madhavi Arora says that while only some banks (Public Sector Banks specifically) benefitted more than others from the liquidity glut due to the Rs 2K notes withdrawal, all the banks will have to maintain the ICRR and this could be construed as unfair to some banks who did not benefit much from the Rs 2K notes withdrawal (mainly Privare Sector Banks).

According to Arora, if the ICRR of 10% had been assumed to include the existing CRR of 4.5%, the liquidity depletion would have only amounted to Rs55,000-65,000 crore.

She says that the move would also lead to some interest loss for banks, as banks were parking the short-term liquidity into STPL (short-term personal loans) and money markets, instead of parking with RBI in VRRR, which also helped in some softening of CP/CD rates.