The RBI has fired warning shots on the issue of rising personal loans, once again.

In April, the central bank had first cautioned lenders over their rising unsecured loan portfolio, particularly personal loans, credit cards, small business loans and microfinance loans.

On Friday, it again raised the red flag, asking scheduled commercial banks and NBFCs to look under the hood for signs of stress on account of collateral-free personal loans and take suitable measures.

Further, it said the RBI's binoculars were out in full force and that the banking regulator will 'act proactively to maintain financial stability.' It means the central bank will step in with prudential regulations to limit such unsecured lending should lenders remain reckless.

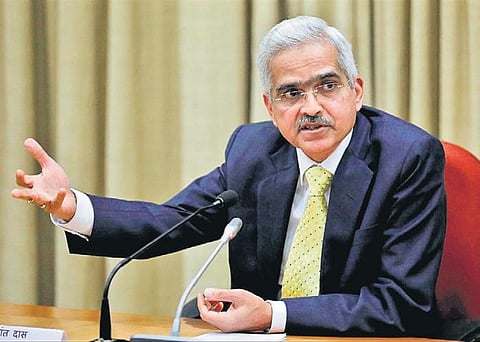

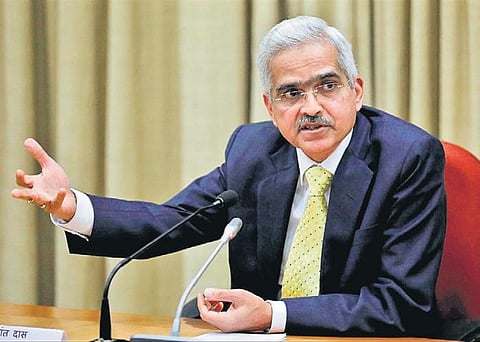

While RBI Governor Shaktikanta Das during the customary post-policy review reasoned that Friday's warning should be seen as an advisory or first line of defence to lenders, it's undeniable that the unstoppable growth in personal loans raises the risk of bad loans.

As latest RBI data showed, the share of personal loans in total non-food credit touched an all-time high of 30% in FY23. For three years in a row, the personal loans segment remained the largest component of bank credit, overtaking industrial credit, which until recently was the undisputed leader for decades.

Within the overall retail loan portfolio, personal loans segment registered 20.6% in FY23, and within personal loans, credit card outstanding saw the highest growth of 31%.

"Certain components of personal loans are, however, recording very high growth. These are being closely monitored by the Reserve Bank for any signs of incipient stress. Banks and NBFCs would be well advised to strengthen their internal surveillance mechanisms, address the build-up of risks, if any, and institute suitable safeguards in their own interest," Das noted in his monetary policy statement on Friday.

Any increase in retail loans going sour will affect banks, which just about managed to get over the twin-balance crisis, which itself was due to limitless lending to the industry, good and bad. Until now, bad loans, writeoffs and provisions in the retail sector are negligible, but the looming retail credit cycle could alter that and thereby put pressure on margins.

"The need of the hour is robust risk management and stronger underwriting standards," Das said.

The total credit to the segment stood at Rs 47.70 lakh crore in August 2023 as against Rs 36.47 lakh crore in August 2022. Credit to the sector from April 2023 to August 2023 grew from Rs 40.85 lakh crore to Rs 47.70 lakh crore, registering a growth of 16.8%, compared to 7% in the corresponding period a year ago.