Launch of UPI services in Sri Lanka, Mauritius symbol of Global South cooperation: PM Modi

NEW DELHI: Prime Minister Narendra Modi said on Monday that the launch of India's UPI services in island countries Sri Lanka and Mauritius is a symbol of India's cooperation with the Global South.

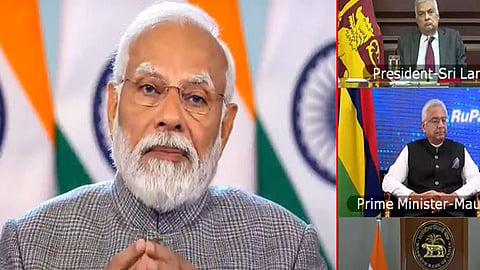

Addressing the launching ceremony virtually, in the virtual presence of Sri Lanka President Ranil Wickremesinghe and Mauritius Prime Minister Pravind Jugnauth, PM Modi said he was confident that Indian tourists would prioritise these destinations with the availability of Unified Payments Interface (UPI).

"The Indian diaspora in Sri Lanka and Mauritius will benefit from this initiative. This will reduce the dependence on hard currency. The use of UPI and Rupay card facilities will enable payments in our own currency at a cheaper rate," PM Modi said.

"This launch is a symbol of Global South cooperation. Our relations are historic. Over the past 10 years, we have shown how India stands firm with its neighbour in challenging times," PM Modi added.

Nations that are regarded as having a relatively low level of economic and industrial development are referred to as the Global South.

A key emphasis of the Indian government has been on ensuring that the benefits of UPI are not limited to India only, but other countries, too, benefit from it.

Also, RuPay card services have been launched in Mauritius today. The extension of RuPay card services in Mauritius will enable Mauritian banks to issue cards based on the RuPay mechanism in Mauritius and facilitate usage of RuPay Card for settlements both in India and Mauritius.

India has emerged as a leader in fintech innovation and Digital Public Infrastructure. India has placed a strong emphasis on sharing our development experiences and innovation with partner countries. Given India's robust cultural and people-to-people linkages with Sri Lanka and Mauritius, the launch will benefit a wide cross-section of people through a faster and seamless digital transaction experience and enhance digital connectivity between the countries.

The launch will enable the availability of UPI settlement services for Indian nationals travelling to Sri Lanka and Mauritius as well as for Mauritian nationals travelling to India.

Further, PM Modi said it was an important event for three countries in the Indian Ocean region.

"Today is a special day for three friendly countries in the Indian Ocean region. Today we are connecting our historical relations in a modern digital way. This is proof of our commitment to the development of our people," PM Modi said.

"FinTech connectivity will not only boost cross-border transactions but also connections. India's UPI (Unified Payment Interface) is now playing the role of 'Uniting Partners with India'," he added.

He asserted that Digital Public Infrastructure such as UPI has brought about changes in the smallest of villages in India, as the technology is convenient and fast.

In 2023, a record 100 billion transactions valued at Rs 2 trillion were made via UPI, PM Modi said.

"Digital Public Infrastructure has brought about a revolutionary change in India. Even the smallest businessman in our smallest village is making digital payments because it has convenience as well as speed," he said.

Unified Payments Interface (UPI) is India's mobile-based fast payment system, which facilitates customers to make round-the-clock payments instantly, using a Virtual Payment Address (VPA) created by the customer.

UPI payment system has become hugely popular for retail digital payments in India, and its adoption is increasing at a rapid pace.

So far, Sri Lanka, Mauritius, France, UAE, and Singapore have partnered with India on emerging fintech and payment solutions.