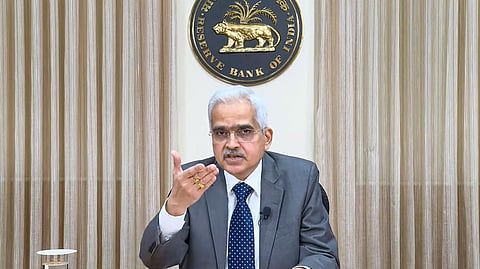

MUMBAI: Governor Shaktikanta Das, who took over the reins of the Reserve Bank after his predecessor Urjit Patel resigned following long-running public spats with the government over the autonomy of the central bank in December 2018, has said the bank's relations with the government have been "smooth" during his nearly six-year term and that nobody has asked him to be the “cheerleader of the government” as yet.

Das also credited this smooth functioning to the close coordination between the North Bloc and the Mint Road, which helped the quick revival of the economy after the pandemic.

Speaking at a Financial Express event here Friday morning, the bureaucrat-turned-central banker said “Nobody has asked him to be a cheerleader for the government during his term.”

"I am saying this from my experience. Nobody expects the RBI to be a cheerleader. I have had no such experience," Das said, responding to a specific question about a lament made by D Subbarao, one of his predecessors, in a recent book.

During the times of Subbarao, the tussle between the government and the RBI over interest rates and other monetary measures was getting into public spats. While Subbarao and then finance minister P Chidambaram had so many indirect spats on the rates, the issue became more publicly pronounced and frequent during Urjit Patel’s tenure.

The worst of the contentions were the demonetization and then the government demand for transferring the entire surplus of the RBI to the government when the late Arun Jaitley was helming the finance ministry, which eventually led to one of the rare resignations before term by Patel in December 2018.

Asked if he is open for a new term at the Mint Road, Das said he is very focused on the current assignment and does not think of anything outside that.

On growth, Das said the RBI is optimistic that its estimate of 7.2 percent growth for FY25 will be met and that with steady growth, the focus of the policy has to be "clearly and unambiguously on controlling inflation.”

"The inflation elephant is taking pauses and grudgingly moving towards the forest, or the 4 percent target, in a unidirectional way, he rued. He also underlined the need for remaining focused on inflation, saying that even at the current rate of interest, the economy has been doing well, which in other words means that the central bank’s focus should be meeting the legally mandated 4 percent inflation.

Repeating his warnings to banks on the rising risks from the increasing asset liability mismatches, Das asked lenders to be watchful of the lag between credit and deposit growth and advised that the former should not exceed the latter as the financial system can get exposed to "structural liquidity issues" due to the lag between credit and deposit growth.

Stating that the financial landscape of the country is undergoing structural shifts and that the lag in deposit mobilisation compared to credit growth is a critical issue, he said there has been a noticeable trend of households increasingly shifting their investments to capital markets and other financial intermediaries. The trend has led to a decline in the share of bank deposits.

Amid concerns about mule accounts being used by fraudsters, Das asked banks to strengthen their customer onboarding and transaction monitoring systems to check for unscrupulous activities. He also said that the RBI is working with banks and law enforcement agencies to check mule accounts and digital frauds.

Das said the RBI's actions on unsecured lending have had the desired impact, and growth in the focus segment has moderated, but he flagged concerns about the high ceilings on unsecured lending kept by some banks despite having high exposures already. He advised prudence to such banks and added that they should avoid exuberance.

To another question, he said the RBI is not looking at any proposal on allowing corporate entities to own or promote banks at present, citing global examples and the problems in monitoring related party transactions, which is very risky.

Stating that the country does not need a proliferation of banks but well-governed and stable institutions, he said that the RBI will look at any proposal to open a new bank under the on-tap licensing facility, but the license will be contingent on the existing qualifying norms.