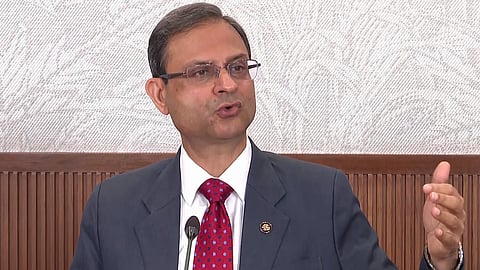

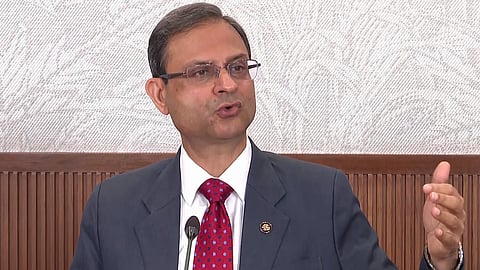

MUMBAI: Reserve Bank governor Sanjay Malhotra has said that even as the all-popular unified payments interface (UPI) remains free for users, someone is already covering the cost, adding that the government will ultimately decide who bears the operational expenses.

Addressing reporters at the customary post-policy presser here Wednesday when the RBI-MPC maintained the status quo on rates, the governor was responding to a query on his earlier statement on the issue.

Asked whether charges such as the merchant discount rate (MDR) can be passed on to consumers, the governor clarified, “I never said that UPI cannot stay free forever. What I said was there are costs (associated with UPI transactions), and they need to be paid for by someone."

“The question was whether charges like MDR would be passed on to consumers. I responded by saying that there are costs involved," he said about his previous statement at an industry event last week in the city.

“There are costs, and these costs have to be paid by someone. Who pays is important but not as important as the fact that someone is footing the bill,” the governor said, adding, “My sense is that it is not free even now, and someone is paying for it. The government is subsidising it, but somewhere, the costs are being paid.”

Introduced in 2016 by the RBI-run National Payments Corporation, the UPI currently accounts for about 80% of retail digital payments in the country and is a global success when it comes to digital payments. On average, UPI handles 30 crore transaction a month, which in July was 31 crore.

Since January 2020, UPI transactions have been exempt from MDR, a fee typically charged to merchants by banks for processing digital payments.

The governor’s clarification come after some banks such as ICICI Bank have started levying fees on UPI transactions from August 1 involving certain merchant categories or routed through payment aggregators, raising questions over the long-term viability of the no-cost model.

In June, the finance ministry had dismissed reports that MDR would be levied on UPI transactions, calling the claims “completely false, baseless, and misleading. The government remains fully committed to promoting digital payments via UPI."

Highlighting the costs associated with UPI transactions, Malhotra repeated, “Who pays is important but not so important than someone footing the bill. Someone will eventually need to cover these expenses. The sustainability of the UPI model is crucial. It is important to determine who will bear the cost. This could be done collectively or individually.”

It may be noted that ICICI Bank has become the first to formally introduce processing charges for payment aggregators handling UPI transactions from August 1.

ICICI Bank is reportedly charging payment aggregators (PAS) with escrow accounts held at the bank a fee of 2 basis points (Rs 0.02 per Rs 100), capped at Rs 6 per transaction. For PAs without an escrow account with ICICI, the charge rises to 4 bps, capped at Rs 10. Transactions routed through the merchant’s ICICI Bank account will not attract any fee.

Speaking at the BFSI summit in Mumbai last week, the governor had similarly underlined that UPI's zero-cost model may not be sustainable in the long run. “UPI is an important infrastructure. The government has taken a view it should be available free and is subsidising it. And I would say it has borne good fruits,” referring to the exponential growth in digital payments. In June, as many as 18.4 billion UPI transactions were conducted—up 32% on-year, according to NPCI data.