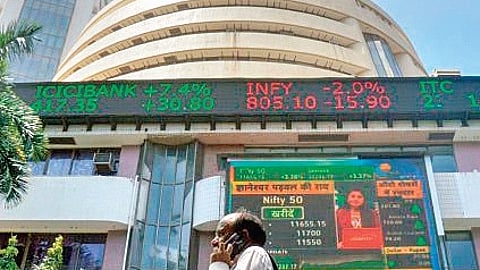

Sensex rises 1.8 per cent as trade tension eases

NEW DELHI: Domestic equity market surged on Tuesday as global trade tensions eased after US PresidentFormer President Donald Trump postponed new tariffs on goods from Mexico and Canada by one month. Additionally, the planned 10% levy on Chinese exports to the US did not take effect as scheduled on Tuesday.

Following these positive global cues, the Indian equity benchmarks – BSE Sensex and NSE Nifty – rallied up to nearly 2% on Tuesday. After hitting an intraday high of 78,658.59, the 30-share index Sensex settled at 78,583.81, up 1,397.07 points or 1.81% while the Nifty50 ended at 23,739.25, up 387.20 points or 1.62%. The index traded in the range of 23,762.75 to 23,423.15 on Tuesday.

Investors’ wealth rose by Rs 5.89 lakh crore to Rs 425.40 lakh crore (BSE m-cap) on Tuesday compared to Rs 419.54 lakh crore recorded on Monday.

Index heavyweight HDFC Bank and Reliance Industries gained between 2.5-3%. Broader markets also advanced on Tuesday as the Nifty Midcap100 index ended higher by 1.56% and the Nifty Smallcap100 index closed with gains of 1.09%.

“Yesterday, the Indian market struggled to absorb the optimism generated by the union budget due to heightened geopolitical risks stemming from ‘Trump tariff war’. However, India could outperform in a weak global market and as a rebound has been triggered in the global sentiment, it has fuelled a sharp surge in domestic equities,” said Vinod Nair, research head, Geojit Financial Services.

Nair added that banking stocks are rallying in anticipation of a rate cut in this week’s RBI policy, the new governor’s first meeting. Nifty PSU Bank and private bank indices gained over 2% each. The Bank Nifty index, which tracks the performance of 12 large banking stocks, advanced 1.93% at 50,157.95. Market experts said Street has turned its focus to the RBI’s policy decision on February 7. They, however, feel that volatility will continue as it is highly difficult to predict US President Donald Trump’s future actions.

Ajit Mishra – SVP, Research, Religare Broking, said that a strong start, driven by a rebound in global markets, gained further traction as renewed buying in select heavyweight stocks sustained the upbeat sentiment throughout the session.