Equity benchmarks close slightly higher as bank stocks counter IT selloff

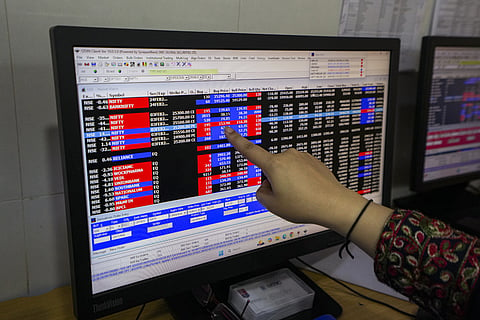

Indian equity benchmarks ended Wednesday’s session with modest gains after a volatile day of trade, as selective buying in heavyweight stocks helped offset weakness in information technology shares. The BSE Sensex closed near 83,818, while the NSE Nifty 50 finished around 25,776, with both indices managing to hold on to small advances despite sharp intraday swings.

As predicted by stock analysts in the morning, markets opened on a cautious note and slipped into negative territory early in the session, weighed down by heavy selling pressure in frontline IT stocks following fresh concerns over global technology spending and competitive pressures in artificial intelligence. Stocks such as Infosys, TCS and Wipro declined sharply, dragging the Nifty IT index to one of the steepest single-day falls in recent weeks. The early weakness, however, attracted bargain hunting in select large-cap banking, industrial and energy stocks, allowing the benchmarks to recover steadily through the second half of the session.

Banking and financial stocks provided a key pillar of support, with investors continuing to position themselves in lenders seen as beneficiaries of sustained credit growth and improving asset quality. Select public sector banks and large private lenders attracted buying interest, helping limit the broader market’s downside. Energy and metal stocks also saw mild gains on the back of firmer global commodity prices, while defensive pockets such as FMCG and healthcare traded in a narrow range.

The overall market tone reflected a phase of consolidation after recent gains, rather than a decisive shift in trend. Traders appeared reluctant to chase prices higher at current levels, preferring to rotate into specific sectors and stocks with clearer near-term visibility. Mid-cap and small-cap indices ended mixed, indicating that risk appetite remains selective and stock-specific.

From a technical perspective, the Nifty’s ability to hold above the 25,700 zone is being viewed as a sign of underlying strength, even as resistance continues to cap sharp upside moves. Market participants note that a sustained move above recent highs would require stronger participation from IT and other heavyweight sectors, which have lagged in the past few sessions.

Looking ahead, investors are likely to stay focused on corporate earnings, global market cues and developments around trade and geopolitics. While the broader medium-term outlook remains constructive, Wednesday’s trade underscored that markets are entering a phase where gains may be harder to come by, and short-term volatility is likely to persist alongside selective opportunities.