MUMBAI: Finance Minister Nirmala Sitharaman has announced that NPS Vatsalya subscribers will receive the same tax benefits under Section 80CCD(1B) as regular NPS subscribers for their contribution, provided they opt in to remain under the old income tax regime and not in the new regime, which does not allow any deductions but offers a higher tax free income level of Rs 12 lakh. The proposal comes without any revision in the income tax slabs and rates under the old tax regime.

The government proposes to give a tax deduction of Rs 50,000 under the old regime to subscribers of the new pension scheme under the Vatsalya bracket, thereby treating this scheme at par with regular NPS accounts. This will take the present tax deduction under section 80-C to Rs 2 lakh from the present Rs 1.5 lakh limit.

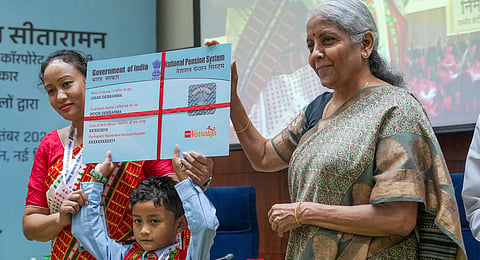

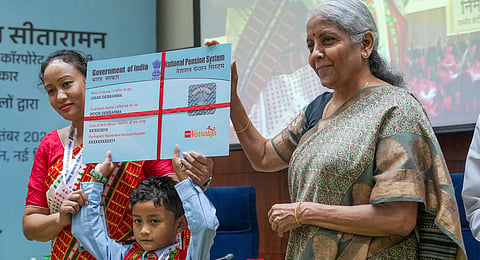

The NPS Vatsalya scheme was launched in September 2024 after being announced in the July 2024 budget. It is a National Pension Scheme (NPS) for minors, allowing parents to contribute a certain amount annually on behalf of their children to secure their future and help them develop a retirement fund.

Under the NPS Vatsalya scheme, when a minor turns 18, the account will continue to be operational, transferred to the child's name with the accumulated corpus and will be shifted to the NPS-tier 1 account.

The objective of the scheme is to create a corpus for children over the long-term by letting parents/guardians contribute a minimum of Rs 1,000 annually, without any maximum investment limit. Since there is compounding effect over the long-term, it can ensure that even smaller amounts invested regularly grow into a substantial corpus by the time children turn into adults and start drawing their own income.

“It is proposed to extend the tax benefits available to the NPS under sub-section (1B) of section 80CCD of the Income-tax Act, 1961 to the contributions made to the NPS Vatsalya accounts, as applicable and up to Rs 50,000 per annum,” Sitharaman said in her budget speech.

A deduction will be allowed to the parent/guardian’s total income, of the amount paid or deposited in the account of any minor under the NPS up to Rs 50,000, overall as mandated under sub-section (1B) of section 80CCD.

The NPS Vatsalya scheme is regulated and administered by the Pension Fund Regulatory Authority (Pfrda) and is a variant of the existing NPS, tailored explicitly for young individuals.