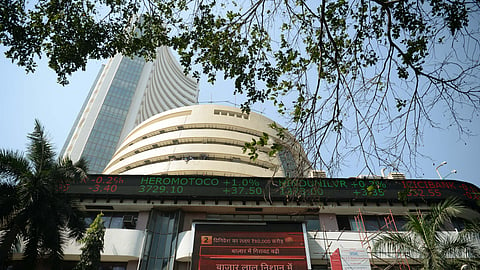

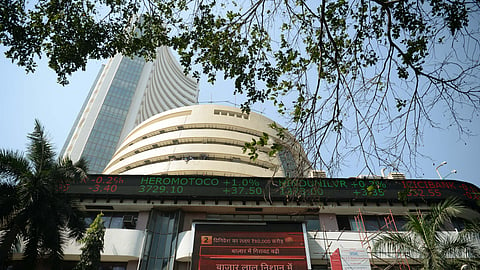

Indian equities opened with a sharp gap-up on Tuesday after the announcement of a trade agreement between India and the United States that slashes reciprocal tariffs and removes penalties linked to India’s Russian crude purchases, triggering a broad-based rally across equities, currency and bonds.

The Sensex opened at 85,323, up almost 4.5% from Monday’s close of 81,666, while the Nifty started at 26,308 against 25,088 earlier. As the initial exuberance cooled slightly, markets still held gains of over 2.7%, with the Sensex at 83,947 and the Nifty at 25,774 at the time of writing.

Market breadth was decisively positive. Of the 3,010 stocks traded on the NSE, 2,587 advanced while only 349 declined.

Among Nifty constituents, Adani Enterprises and Adani Ports led gains, rising over 10% and 7.5% respectively. Only three Nifty stocks — Nestle, ONGC and Coal India — traded in the red.

US President Donald Trump indicated on Truth Social, and Prime Minister Narendra Modi confirmed on X, that the US would reduce reciprocal tariffs on Indian goods to 18% from as high as 50%, while also removing the additional duty imposed over India’s purchase of Russian crude oil.

Though formal documentation is awaited, markets inferred that India has committed to purchasing nearly $500 billion worth of US agricultural, energy, technology and other commodities over time.

Dhiraj Relli, MD & CEO, HDFC Securities, said: “We welcome the announcement of a landmark trade agreement between India and the United States. At 18%, India’s tariff rate is now lower than that of several major Asian trading partners, supporting growth in labour-intensive and export-oriented sectors such as textiles, gems and jewellery, and engineering goods.”

“The removal of additional duties linked to Russian crude purchases offers greater stability to both the rupee and domestic markets and significantly enhances India’s competitive position.”

Analysts estimate the effective tariff rate for India now stands at around 14.1% (18% reciprocal tariffs under IEEPA plus Section 232 provisions), placing India at par — or slightly better — than export competitors such as Bangladesh, Vietnam and Thailand.

Rupee opens stronger; seen reversing trend

The rupee reacted immediately, opening sharply stronger at around 90.50 per dollar.

Jigar Trivedi, Senior Research Analyst at IndusInd Securities, said: “The deal effectively dismantles a punitive tariff regime that had seen duties on Indian exports climb to 50%, the highest in Asia. By removing penalties linked to Russian energy and slashing tariffs to 18%, the agreement is expected to encourage a return of foreign capital.”

“This removes a chunk of policy and tariff uncertainty that had been weighing on Indian assets, opening the door for a near-term bounce in the rupee and equities via sentiment and foreign flows.”

“The rupee was the worst-performing Asian currency in 2025. This agreement could break the self-reinforcing cycle of hedging that had kept the currency under pressure.”

Currency strategists now see USD/INR gradually moving towards the 88.5–89 range in the coming weeks if foreign portfolio flows resume.

External risks ease; growth outlook improves

Brokerage estimates suggest the trade deal, along with recently concluded FTAs with the UK and EU, materially reduces India’s external sector risks.

Analysts project a 0.1–0.2% of GDP improvement in the current account deficit outlook for FY27 from the earlier projection of 0.9% of GDP, while the projected $5 billion BoP deficit may ease if FPI flows reverse.

One brokerage note said: “Since the tariff reduction is effective immediately, we expect a 40 basis point fillip to India’s nominal GDP growth in FY27, ceteris paribus. Over the medium term, the EU and US trade agreements together can add nearly 60 basis points to nominal growth.”

Export sectors, banks seen as key beneficiaries

Export-heavy sectors like Gems and Jewellery, Textiles and apparel and Machinery and equipment are expected to benefit immediately.

Banks and financial institutions with exposure to these segments may see improved outlook due to reduced trade uncertainties.

A market strategist at a domestic brokerage Elara Securities said: “Banks with exposure to export-linked MSMEs and working capital finance in these sectors stand to gain as order visibility improves and trade risks recede.”

Automobiles, however, may not see immediate relief as tariffs under Section 232 remain in place.

Bonds to see near-term relief

The improved macro outlook is also expected to support the bond market.

A debt market dealer at a primary dealership said: “The immediate reaction will be positive for bonds as external risks decline and currency stability improves. But structurally, we still see the 10-year yield drifting towards 6.9–7% over the medium term on growth expectations.”

Import commitments raise some questions

While the deal is seen as overwhelmingly positive, India’s reported commitment to buy large volumes of US energy, agricultural and technology products may raise concerns.

A trade policy expert said: “Much will depend on how the $500 billion import commitment is structured over time. If it replaces cheaper sources like Russian crude, some of the gains may be offset. The details will be crucial.”

Services exports will be another key monitorable as Global Capability Centres (GCCs) evolve as a preferred execution model amid tighter US visa scrutiny.

US services imports from India stood at $40.6 billion in CY24.

An analyst tracking IT services said: “If tariff tensions ease and trade relations stabilise, it could also indirectly support the services ecosystem, particularly GCC expansions and consulting exports.”

With tariff uncertainty lifting, foreign flow prospects improving and India having underperformed emerging markets so far this year, analysts believe Indian equities could emerge as one of the best-performing asset classes in the coming weeks.