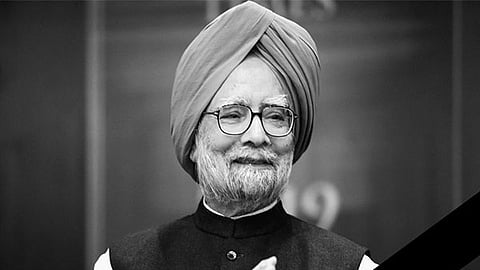

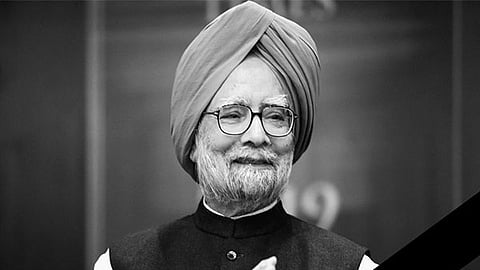

NEW DELHI: The architect of the first round of India’s economic reform – Dr Manmohan Singh, the former prime minister and finance minister – breathed his last late on Thursday night.

Mr Singh, who is known for heralding the era of market economy in India, is fondly remembered more for his stint as the finance minister of India under Prime Minister PV Narasimha Rao than his two stints as the prime minister in the UPA government from 2004 to 2014.

Dr Manmohan Singh kick-started the economic reform process of India with his landmark budget in 1991. But more than the 1991 budget, the New Economic Policy adopted by the then government under Prime Minister PV Narasimha Rao and Finance Minister Manmohan Singh led the path for economic reforms. Manmohan Singh is credited with the drafting of NEP 1991.

The NEP 1991 not just unshackled the industry, but also brought in fiscal and monetary discipline, and paved the way for privatization in a big way. The banking sector was freed from the excess control of the regulator.

Key features of NEP 1991

Fiscal discipline: The government set the target of bringing down the fiscal deficit to 3-4% in the medium term. As a first step, the government set the target of bringing the fiscal deficit target of 1992-93 to 5%, down from 6.2% in the previous year. The target was to be achieved through major cuts in subsidies and non-planned expenditures. Simultaneously, the government announced major tax reforms to boost its tax revenue.

Monetary policy reforms: Tighter measures were planned to reduce non-discretionary imports. For that cost of import credit was increased. A tighter monetary and credit policy was envisaged to contain the current account deficit. New monetary tools like 364-day T-bills, and 10 and 15-year securities were introduced for the government to borrow from the market.

Banks were freed from regulatory control to decide the deposit rates and maturities.

Trade policy reforms: Rupee was devalued 18% to make Indian exports competitive in the international market. Import restrictions for exporters were massively reduced. Import of capital goods was allowed without the need of government permission. Export trading houses were allowed to have 51% foreign equity.

Industrial policy reforms: Greater private sector participation was allowed in core and basic industries. Number of industries reserved for the public sector was reduced to 8 from 17. Industrial licensing was abolished for all industries except 18 environmentally risky sectors.

The monopolies and Restrictive Trade Practices (MRTP) Act was amended to eliminate the need for permission by large companies for capacity expansion. Small-scale enterprises were allowed to sell 44% equity to large companies.

Measures to boost FDI: The limit for foreign equity holding raised from 40% to 51% in priority sector industries. Foreign Investment Promotion Board was established to streamline the process of approval of FDI.