For the RBI, it's all about timing right now.

The central bank is walking that final bridge between pause and pivot, but the hour's growing late for rate cuts, as elevated food prices continue to seize household budgets by the throat.

In response, the six-member Monetary Policy Committee (MPC), in a 4-2 vote split on Thursday, kept rates unchanged for the ninth consecutive time. That's over 18 months in a row. The benchmark repo rate, or the rate at which RBI lends to banks, stands pat at 6.5%.

Headline inflation is moderating, but the process of disinflation is uneven, slow and way below the central bank's desired trajectory, thanks to high food prices. From 3.8% in FY22, food inflation increased to 6.6% in FY23 and 7.5% in FY24, suggesting a 97% surge in the last two years. Even if you take the monthly inflation prints, food inflation contributed more than 75% to headline inflation in June, with vegetable prices alone contributing about 35%. In fact, the high food price momentum is likely to have continued in July too as prices of various food items like tomatoes, onion or pulses are simply popping up at frequent and untimely intervals, one after the other.

Considering the situation, just last fortnight, the Economic Survey 2023-24 urged RBI to consider targeting inflation excluding food, whose prices are influenced more by supply than demand. Short-run monetary policy tools are meant to counteract price pressures arising out of excess aggregate demand growth. Deploying them to deal with inflation caused by supply constraints may be counterproductive, it reasoned. Put another way, RBI's policy rate hikes or cuts are much like tossing a glass of water towards the flames -- simply ineffective to tame food prices.

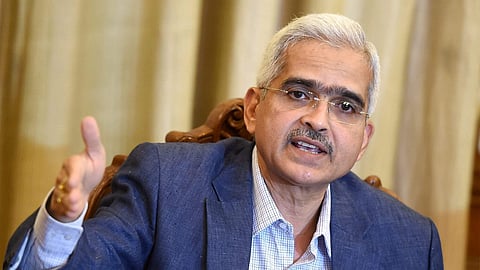

Perhaps responding to the Survey's suggestion, Governor Shaktikanta Das issued word on Thursday morning that the central bank will do no such thing.

For, food constitutes over 46% of the inflation basket, and Das reasoned that such a high share cannot be ignored while computing the headline inflation rate. Moreover, he stressed that the central bank will remain vigilant over the spillover or second round effects of high food prices. The persistent price shocks are keeping headline inflation above the central bank's target of 4%, preventing it from cutting interest rates. Between February 2023, when the central bank last raised rates and now, inflation and growth are going in downward and upward directions respectively, just as they should.

The bad news though is that the sacred 4% target is more than a year away with RBI projecting headline inflation to remain above 4% even in the first quarter of next financial year. As for the current fiscal, given Q1 inflation settled at 4.9%, the central bank has retained its previous projection of 4.5% for the full fiscal FY25. The good news is, a degree of relief is expected in coming months, thanks to monsoon rains that are projected to be above normal in August-September, and higher reservoir levels boding well for winter crops. Consequently, headline inflation for Q2 is pegged at 4.4%, Q3 at 4.7% and Q4 at 4.3%. For Q1, FY26, headline inflation is estimated at 4.4%.

Meanwhile, citing resilience in domestic economic activity, RBI has retained its previous prediction of 7.2% real GDP growth for FY25. Further, Das insisted that the central bank's ceaseless vigil on price stability is just what is needed to sustain India's high growth path. FY25, Q1 GDP is pegged at 7.1%, Q2 at 7.2%, Q3 at 7.3% and Q4 at 7.2%, with risks evenly balanced. The growth momentum is likely to extend to Q1, FY26 when real GDP is pegged at 7.2%.

That said, the global economic backdrop appears to be mixed. Central banks in advanced economies have retired the higher-for-longer interest rate narrative at last and have embarked on a broad-based global policy easing. Some like the Bank of England have even begun cutting rates, while the US Federal Reserve indicated at least one rate cut in 2024. But Das simply doesn't believe in following the same recipe and baking the same cake. As he often reiterates, RBI's rate actions will be influenced purely by domestic factors.

Globally, the near-term outlook looks positive, but Das is watchful and is standing guard with a coherent policy approach to deal with any significant challenges that could crop up in the medium term. Global markets are witnessing turmoil, but he urged market participants to be mindful of India's inherent strengths and the buffers built-in to withstand even extreme volatility.